Stock costs should not decided in line with a single technique, and it is vitally tough to predict them. Some economists say that they depend upon the long term earnings of the corporate. Investors normally buy the shares which they suppose will make profits in the future. This, in turn, causes the value of that exact inventory to increase. Again, it is the demand that truly is causing the rise. However, the opposite happens when an organization will not be anticipated to make profit. Here the demand is low for that particular inventory, and due to this fact, it causes the worth to fall.

Stock costs should not decided in line with a single technique, and it is vitally tough to predict them. Some economists say that they depend upon the long term earnings of the corporate. Investors normally buy the shares which they suppose will make profits in the future. This, in turn, causes the value of that exact inventory to increase. Again, it is the demand that truly is causing the rise. However, the opposite happens when an organization will not be anticipated to make profit. Here the demand is low for that particular inventory, and due to this fact, it causes the worth to fall.

Optimism over forecasts has caught the eye of anxious investors, who hope that robust earnings can assist lofty inventory valuations and offset the considerations over rising bond yields and the pace of Federal Reserve rate hikes. Rising interest rates generally mean greater borrowing costs for corporations. Stocks whose future earnings are rising, which means the corporate’s earnings are anticipated to not only develop but to continually develop quicker, deserve a really high PE ratio. These are very risky stocks, however can provide enormous returns if their progress fee continues to increase.

In economics and financial principle , analysts use random stroll strategies to model habits of asset costs , specifically share prices on stock markets , forex exchange rates and commodity costs. This follow has its foundation in the presumption that investors act rationally and without biases, and that at any second they estimate the value of an asset based on future expectations. Under these circumstances, all existing info impacts the price, which modifications solely when new data comes out. By definition, new info appears randomly and influences the asset worth randomly.

The Wall Street Journal’s Money Flows Buying On Weakness chart is an inventory of shares that have dropped and seen the largest inflows of money. This checklist is updated every 15 minutes and exhibits you exactly how a lot money is coming right into a stock versus the cash going out. This is a good instrument for serving to you evaluate which crushed down shares traders really feel the strongest about.

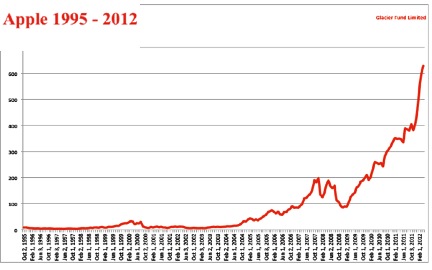

If it appears just like the economy is going to develop, stock prices may rise. Investors might buy more shares thinking they are going to see future profits and higher stock costs. If the financial outlook is uncertain, traders might reduce their shopping for or start promoting. When considered over lengthy periods, the share value is expounded to expectations of future earnings and dividends of the agency. 2 Over quick intervals, especially for youthful or smaller companies, the connection between share price and dividends might be quite unmatched.