Why Do The Stock Prices Go Up And Down?

Stock costs should not decided in line with a single technique, and it is vitally tough to predict them. Some economists say that they depend upon the long term earnings of the corporate. Investors normally buy the shares which they suppose will make profits in the future. This, in turn, causes the value of that exact inventory to increase. Again, it is the demand that truly is causing the rise. However, the opposite happens when an organization will not be anticipated to make profit. Here the demand is low for that particular inventory, and due to this fact, it causes the worth to fall.

Stock costs should not decided in line with a single technique, and it is vitally tough to predict them. Some economists say that they depend upon the long term earnings of the corporate. Investors normally buy the shares which they suppose will make profits in the future. This, in turn, causes the value of that exact inventory to increase. Again, it is the demand that truly is causing the rise. However, the opposite happens when an organization will not be anticipated to make profit. Here the demand is low for that particular inventory, and due to this fact, it causes the worth to fall.

Optimism over forecasts has caught the eye of anxious investors, who hope that robust earnings can assist lofty inventory valuations and offset the considerations over rising bond yields and the pace of Federal Reserve rate hikes. Rising interest rates generally mean greater borrowing costs for corporations. … Read more

Continue Reading LONDON (Reuters) – Google is to bolster its Google Finance service by giving retail investors free access to actual-time London Stock Exchange share prices.

LONDON (Reuters) – Google is to bolster its Google Finance service by giving retail investors free access to actual-time London Stock Exchange share prices. Who knows when the Ides of March will roll round for the stock market. Donald Trump seems to always praise the stock market as his own vehicle to his personal greatness. Some Presidents up to now have alluded to the stock market, but they’ve by no means attributed their success to it. Trump however, is the primary to tweet on any information of a market rise about how his own self-proclamation acts as a thrust to create new wealth for the American client.

Who knows when the Ides of March will roll round for the stock market. Donald Trump seems to always praise the stock market as his own vehicle to his personal greatness. Some Presidents up to now have alluded to the stock market, but they’ve by no means attributed their success to it. Trump however, is the primary to tweet on any information of a market rise about how his own self-proclamation acts as a thrust to create new wealth for the American client. There are several completely different iPhone / iPad inventory market video games that let people use a mobile utility to simulate buying and selling shares available on the market. These apps are a whole lot of enjoyable for people that take pleasure in to observe the market and examine enterprise and see how good of an investor they could possibly be without risking all of their hard-earned money available on the market on whim that they may be right. Using a inventory market recreation permits you to learn how the market works and will get new investors / potential investors fascinated on the earth of inventory trading and investing.

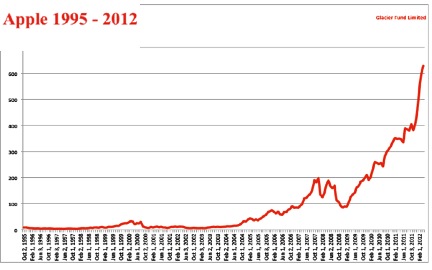

There are several completely different iPhone / iPad inventory market video games that let people use a mobile utility to simulate buying and selling shares available on the market. These apps are a whole lot of enjoyable for people that take pleasure in to observe the market and examine enterprise and see how good of an investor they could possibly be without risking all of their hard-earned money available on the market on whim that they may be right. Using a inventory market recreation permits you to learn how the market works and will get new investors / potential investors fascinated on the earth of inventory trading and investing. People engaged in the buying and selling of shares throughout the world are rising with each passing day. Stocks are being bought and bought every day in very giant volumes on each stock change. All that needs to be accomplished to earn cash in share trading is to have the knack of realizing when to buy which stock and when to sell. This ought to be executed in such a way that the sale takes place when the price of the inventory is highest and the purchase takes place when the value is lowest. The quantity of revenue will depend on the extent of the difference in these costs.

People engaged in the buying and selling of shares throughout the world are rising with each passing day. Stocks are being bought and bought every day in very giant volumes on each stock change. All that needs to be accomplished to earn cash in share trading is to have the knack of realizing when to buy which stock and when to sell. This ought to be executed in such a way that the sale takes place when the price of the inventory is highest and the purchase takes place when the value is lowest. The quantity of revenue will depend on the extent of the difference in these costs.